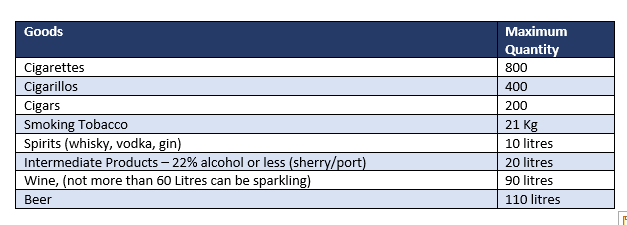

Travellers returning to Ireland from any other EU Country can purchase within the limits set out below. They will be regarded as being for their personal use, though they may have to demonstrate to Customs that if they exceed the ‘limits’ the products are for their personal use. In other words, the ‘limits‘ are indicative and discretionary and may be exceeded. (See Chart)

4 cartons of Silk Cut costs €232 in Portugal this week, the equivalent in any of our stores would cost €612 – “saving” the traveller €380.00.

Any person buying 1 Kg of Golden Virginia will pay €270 in Portugal, the equivalent purchase in Ireland would cost €703, saving €433.00.

Last year, a survey by IPSOS/MRBI commissioned by the Department of Health and Revenue found that 8% of all tobacco consumed in Ireland had emanated from a European Member State other than Ireland. There was no figure given for the percentage of duty-free tobacco brought into the country by travellers coming from the United Kingdom. This 8% represents €162 million lost revenue to the State and Irish retailers. It is the approximate figure that Revenue acknowledged “reappeared” as additional turnover in Irish shops during the restriction in travel caused by the pandemic.

There can be no justification for the Irish Government to continue to permit entry into this country of countless millions of packets of tobacco, the vast majority without appropriate health warnings and complete with advertising logos banned under standardised packaging legislation.

The French and Finnish governments have restricted freedom of movement of tobacco to 200 sticks, our government should do the same.