On 29 March, the Irish government published details of the Final Design principles of the ‘Automatic Enrolment’ (“AE”) Retirement Savings System. Under the new system, eligible employees who do not have an occupational pension will automatically be enrolled into a pension saving scheme. The system intends to address the current low levels of pension coverage in Ireland.

The government’s timeline outlines that we can expect to see the draft legislation in Q3 – Q4 of 2022 and the system set up by 2023 for enrolments in 2024.

How will the enrolment work?

The system will work on an opt-out basis rather than requiring employees to voluntarily opt-in. However, employees will be free to opt-out of the system within a particular window. That window is within the seventh and eighth month following enrolment and the seventh and eighth month following each contribution rate change. Those who opt-out will be automatically re-enrolled after two years but they can still opt-out again in line with the above. Employees will also be free to suspend making contributions at any time.

Employees not already contributing to occupational pensions, aged between 23 and 60, and earning over EUR 20,000 per annum will be automatically enrolled. Employees outside these parameters will still be able to opt-in. Existing members of employer sponsored occupational pension schemes will not be enrolled in the AE system. Employers should note that all staff will be assessed for AE eligibility, regardless of whether they are on probation, casual, or part time, and will be automatically enrolled if they meet the criteria.

How contributions will be made?

It is proposed that employers will be required to match the rate of contribution paid by employees up to a maximum earnings threshold of EUR 80,000 per year. The Government will pay a top up based on 33 % of the employee contribution.

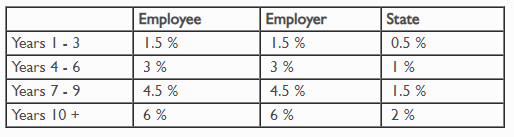

The introduction of the system will be phased in over a decade. Contributions will be made as a percentage of employee’s income and will increase every three years as follows:

This steady phasing allows time for both employers and employees to adjust to the new system. Employer contributions will be eligible for offsetting against corporation tax.

How is the system expected to work?

The government will establish a Central Process Authority (“CPA”) which will be responsible for the overall administration of the system. This body will aim to reduce the administrative burden on employers to source, set-up and administer occupational pension schemes.

Employers must ensure that their payroll process can take instruction for enrolment as well as calculate and remit contributions to the CPA. Failure to do so could lead to an administrative penalty for the employer initially and prosecution if the offence continues.

We will track the progress of the system and provide any relevant updates to members as they occur.