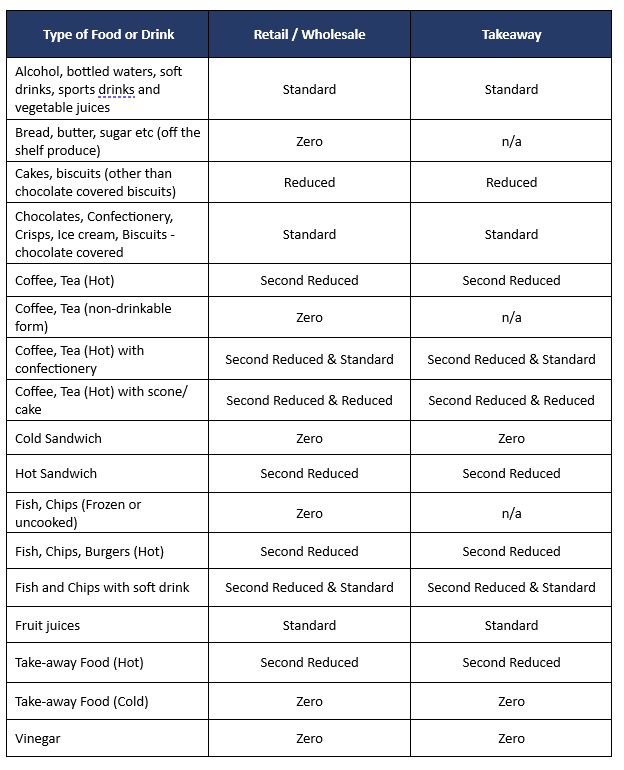

In advance of the anticipated change from the second reduced rate of 9% to the reduced rate of 13.5% we are providing you with the various determinations from revenue regarding food as sold in our premises. Whilst there is a clamor from many in the food service sector to retain the 9% rate, we will have to assume that the stated aim of the Government to reverse to 13.5% from September 1st will prevail. Retailers may wish to consider how they will price their offerings accordingly.

Rate of VAT applicable

The supply of hot takeaway food is liable to VAT at the second reduced rate. This includes food heated, retained heated or supplied while still warm. Hot sandwiches include hot/toasted bread, bagels, baguettes, paninis and wraps and also include cold bread, bagels, baguettes, paninis and wraps that contain hot fillings.

The supply of cold takeaway food is liable to VAT at the zero rate. Chilled, cold or frozen cooked meals are liable to VAT at the zero rate. Cold sandwiches include cold bread, bagels, baguettes, paninis and wraps.

Cold food supplied with hot food for an inclusive price (for example, coleslaw with hot chicken) is liable to VAT at the second reduced rate.

Supplies of alcohol, bottled waters, soft drinks, sports drinks, vegetable juices and fruit juices are liable to VAT at the standard rate.

Combination Meal Deals

Meals of this type consist of items liable at different rates of VAT, typically being hot food liable at the second reduced rate together with a soft drink liable at the standard rate, which are sold together for a single consideration, usually at a discount. Such a discount should be apportioned between the individual items of the meal at their appropriate rates of VAT. For further information please see Revenue’s Guidance on Mixed supplies of goods and services.